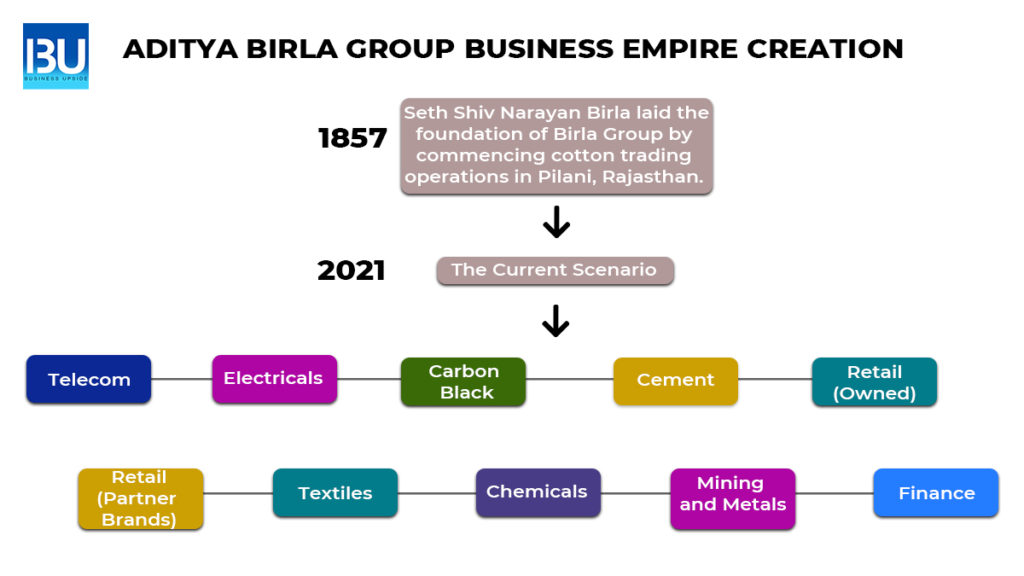

Aditya Birla Group, a globally recognized conglomerate, is one of the fortune 500 companies. Built on a powerful foundation of shareholder value creation, the company has over 1,20,000 extraordinary employees from 42 different nationalities. The conglomerate has established a global powerhouse for over 7 decades in sectors including textile, chemical, metals, cement, telecom, carbon black and fiber, and pulp. At present 50 % of the company’s revenue comes from 36 operating countries located in Asia, Africa, South, and North America.

The Heritage of Aditya Birla Group

The Aditya Birla Groups’ success and values are traced back to the vision and inspiring deals of the legendary leaders, Mr. Ghanshyam Das Birla and Mr. Aditya Vikram Birla. They both established the foundation of Aditya Birla Group both in India and abroad.

-

Mr. Ghanshyam Das Birla

Born on 10th April 1894 at a village named Pilani in Rajasthan, was a pioneer Indian Businessman. G.D Birla, who inherited his family business, which was cotton trading expanded the business of the Birla family expanded rapidly in the 1850s. He went to Kolkata, which was the Jute Hub, and began to be a broker for the same as he wanted to turn his moneylending firm into a manufacturing unit. It was his dedication and hard work, which made him set up the Birla jute mill in 1918. His business skyrocketed, despite the Scottish and the British merchants trying to close down his mill when there was a supply problem at the time of world war I. In 1919, a mill in Gwalior was founded by and “Birla Brother Limited” was founded with an investment of $5 million. It was in the 1940s when he founded Hindustan Motors. It was after India got Independence in 1947, that GD Birla, by acquiring former European companies invested in the textile business and tea industries.

G.D Birla, who is the founding father of the Birla group, set up industries in sectors such as fiber, aluminium, textile, chemicals, and cement. He was a supporter and confidant to Mahatma Gandhi which made him involved in the Indian freedom struggle. He represented India along with Gandhi in the first two round table conferences held in London.

-

Mr. Aditya Vikram Birla

Aditya Birla played an important role in the development of the Indian Industry. At the age of 24, he dared to dream of setting up a business empire with a global presence. It was because of him, that Indian Business appeared on the world map in 1969, even before people knew what globalization was. It was the free and vibrant Southeast Asian market where Aditya volunteered to set up a base for a world-class production. He believed that a business can become global despite having its base in India. It was under his stewardship, that the company rose to be the world’s largest ‘viscose staple fibre’ producer; the Largest palm oil refiner; the third-largest insulator producer, and also the sixth largest carbon black producer. The company attained the status of being the largest grey cement, cement, viscose filament yarn producer, and rayon-grade pulp. It was the only textile firm, which produced linen in India.

In 1995, Aditya passed away due to prostate cancer but brought the company to a position where its global revenue was INR 8000 crore, assets worth INR 9000 crore, 75,000 employees, 55 benchmark quality plants, a community of 6 lakhs shareholders.

It was him, because of which Indian business gained a respected reputation globally.

-

Mr. Kumar Mangalam Birla

Kumar Mangalam Birla, the son of Aditya Vikram Birla succeeded his father to become the chairman of Aditya Birla Group in the year 1995, after his father’s sudden death. The company’s turnover under the stewardship of Kumar Mangalam has increased from US$3.33 Billion in the year 1995 to US$48.3 billion in 2019.

Kumar Mangalam Recognition

| NDTV’s “Global Indian Leader of the Year” | 2007 |

| JRD Tata “Leadership Award” | 2008 |

| CNN-IBN “Indian of the Year Award | 2010 |

| NDTV Profit Business Leadership Awards and “Most Inspiring Leader” | 2012 |

| CNBCTV18 IBLA “Business Leader for Taking India Abroad | 2012 |

| Forbes India Leadership Award – Flagship Award “Entrepreneur of the Year | 2012 |

| Economic Times “Business Leader Award” | 2003, 2013 |

| US India Business Council’s “Global Leadership Award” | 2014 |

| International Advertising Association’s “CEO of the Year Award” | 2016 |

He is currently the chancellor of BITS, chairman of IIM Ahmedabad, IIT Delhi, and A community in Oxford University for “Rhodes Indian Scholarship.” He is also the Honorary Business fellow of the prestigious London Business School and is on its Asia pacific advisory board.

Controversies

The name of Birla is always highlighted in the “Indian coal allocation scam” that happened between 2004-09. In 2013, the CBI accused him of “influencing the then coal secretary in getting the block, Talabira II in Orissa, allocated to Hindalco, when it was meant only for allocation to public sector firms. The investigative agency said that the block was allocated to Neyveli Lignite and Mahanadi Coalfields (both PSUs) in 2005 but sometime in the middle of the year Birla met Parekh after which the earlier decision of the screening committee was overturned and Hindalco was also accommodated along with the two. This led to a notional loss to the exchequer.”

Even in 2016, he was accused by Rahul Gandhi of paying bribes to Narendra Modi, who was the Chief Minister of Gujrat.

It was in 1995, when Kumar Mangalam, a 28-year-old boy inherited his family business. Not everyone believed it would reach the level, it is at today in terms of profit, revenue, and market value. Today, the Birla group is the only one that not only survived the 1991 liberalization but has a net worth of USD 40 billion. After his father’s demise, Kumar Mangalam believed that the only way to make the business profitable and growing continuously is through Mergers and Acquisitions. The company took over businesses in the sector of retail, commodities, and even telecom globally. Essel Mining and Industries which has a revenue of $9.2 billion according to Forbes in 2019, was added to the companies wealth. He prefers to stay low and from the past few years is engaged in consolidating operations to sell his retail vertical to private-equity investors.

One of the first success mantras of Birla was to set up the retirement age of 60 for his group executives. Two prominent incidents show that Birla cannot be cowed and is dedicated to his work. It was in 2001 when Birla bought a 10.5% stake in Larsen and Turbo from Ambani’s after they failed to acquire the company. He was dedicated to taking over L&T’s cement business which he successfully did in 2003 but later sold his stake to Larsen & Toubro employees trust.

Another decision, which led to the success was to get into the wireless telephony business. He got into this business in association with Tata and AT & T. The business skyrocketed initially but had a major fallback later. There were controversies between Ratan Tata and Birla, and at the same time, AT & T sold its stake to the remaining two. The relations between Tata and Birla deteriorated and Idea Cellular was now completely under Birla’s which today is one of the top cellular companies in India.

Looking at his success, Kumar Mangalam decided to buy Novelis, which was a North- American Aluminium producer.

It was one of the biggest risks, an entrepreneur took back in those days. Many analysts had a second thought about this acquisition especially after the crisis of Lehman Brothers but the ball was in the court of Novelis, proving them wrong.

On acquiring Georgia-based Columbian Chemicals for USD 875 million in 2011, the company became the largest producer of carbon black. He even acquired Pantaloons by the future group in 2012 for INR 1600 crores.

Even today he is focused on expanding his family business by merging and acquiring companies with Aditya Birla Group. The company does not just thrive to make money but believes in supporting the Indians. There are Aditya Birla hospitals as well as Aditya Birla Mutual Funds at present.

The Aditya Birla Group has to be given credits for marking Indian Business on the world Map. Their belief, ‘through mergers and acquisitions a company can establish globally’.

Daniyel Chatterjee is a Young Researcher in the field of Data Science & Analytics having research experience of more than 8 years. He has a Masters in Computer Engineering and currently serves as an Editorial Assistant in IGI Global, United States of America. Daniyel also holds honorary positions in the Associate Member of Institute of Research Engineers and Doctors, International Association of Computer Science and Information Technology, International Association of Engineers, Society of Digital Information and Wireless Communications.