What is IPO Grey Market?

IPO grey market is one of the major contributors to the stock markets and is a big part of how it operates. These markets can affect prices and trade volumes in significant ways and it becomes necessary for regulators and authorities to take notice because these markets can lead to a lot of issues in the long run. IPO grey markets are markets in which the stocks of companies that go public trade before they actually do. They can be created by company insiders who sell their shares to private investors before the company’s release. Grey market IPOs are IPOs that are executed outside the exchanges. There are many investors who are not allowed to invest in IPOs on the exchanges due to certain regulations. IPO grey market is where IPO shares are sold at a price that is higher than the IPO price. This happens when there is a rush for shares and the sellers take advantage of this and increase the prices. This doesn’t happen only with IPOs, but also with any other financial asset that gets traded on an exchange.

IPO Grey Market Price

The grey market is a premium paid for the shares of grey market IPO before those shares are listed on the list of the stock exchange. The price of the Grey market premium is changed on a daily basis depending on the petition of the shares in the stock market. There is no specific limitation for IPO Grey market premium as it is based on the claim of the shares. If the stocks before listing contain good demand, then those shares might open with a higher profit.

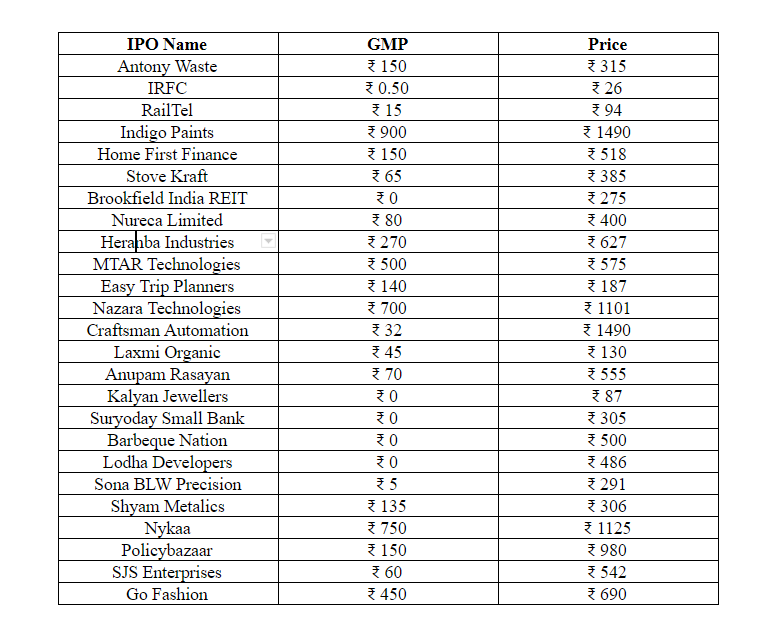

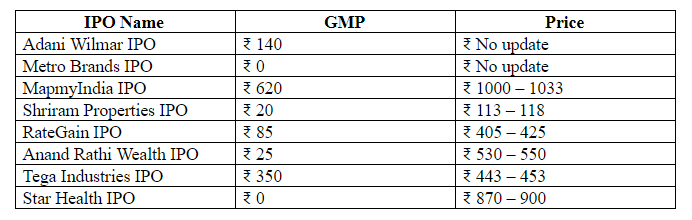

Latest IPO Grey Market Premium

Also Read: The Popularity of Affiliate Marketing in India

Josie Patra is a veteran writer with 21 years of experience. She comes with multiple degrees in literature, computer applications, multimedia design, and management. She delves into a plethora of niches and offers expert guidance on finances, stock market, budgeting, marketing strategies, and such other domains. Josie has also authored books on management, productivity, and digital marketing strategies.