Life insurance is a crucial financial tool that helps protect your loved ones in the unfortunate event of your passing. Term insurance is a popular option that provides coverage for a specific period, typically at an affordable rate. However, traditional term plans don’t offer any returns if the policyholder outlives the term.

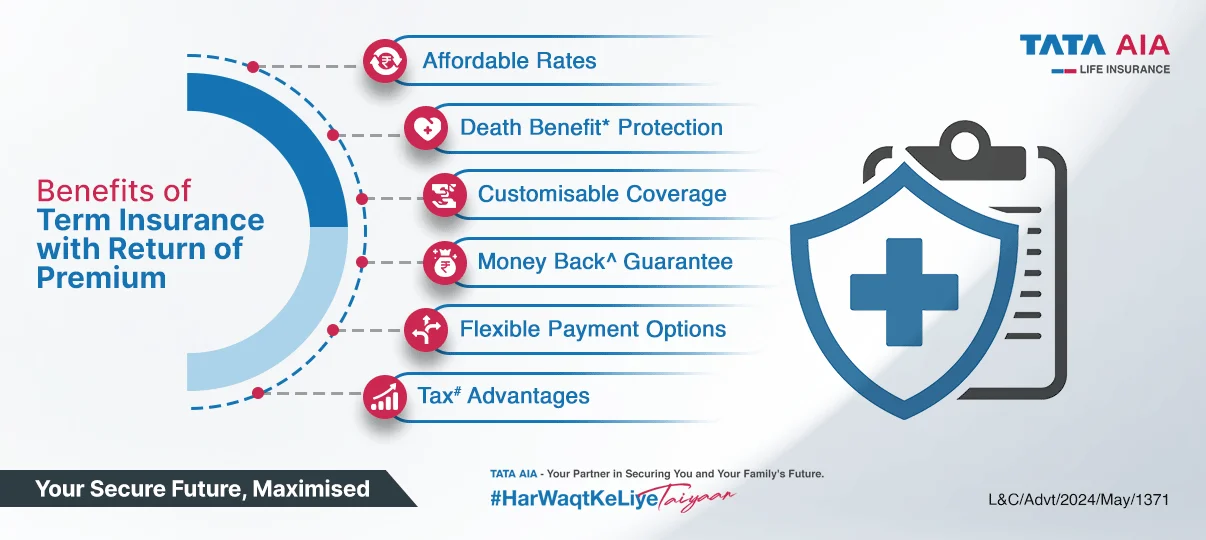

A term plan with premium return addresses this by offering a unique benefit. They combine the security of life cover with the potential for a return on your investment. Let’s explore the advantages of term plan with premium return and how they can be a valuable addition to your financial portfolio.

Term Plan with Premium Return: What You Need to Know

Term plans with premium return function similarly to traditional term life insurance. You pay a premium for a chosen policy term. If you pass away during the policy term, your beneficiary receives a predetermined sum assured to help manage their financial needs.

What sets this plan apart is the return on premium benefit. If you survive the policy term, you’ll get back the premiums you’ve paid throughout the coverage period, minus any applicable charges. In some plans, you might even receive bonus payouts, depending on the specific policy and provider.

The Advantages of Term Plan with Premium Return

There are several compelling reasons to consider a term plan with premium return, making them an attractive option for individuals seeking comprehensive life insurance coverage.

-

Life Cover and Financial Security

Like traditional term insurance, term plans with premium return provide peace of mind by ensuring your loved ones are financially protected if you pass away during the policy term. The death benefit, in case of any such untoward misfortune, can be used to cover expenses like funeral costs, outstanding debts, or even income replacement.

-

Guaranteed Return on Premiums

A key advantage of the term plan with premium return is the guaranteed return of your premiums at policy maturity. This provides a level of certainty and financial security, particularly for individuals with specific savings goals.

-

Potential Bonus Payouts

Some term plans with premium return offer bonus payouts on top of your premiums upon policy maturity. These bonuses can be declared by the insurance company based on their performance and can add to the overall return on your investment.

-

Tax Benefits

Similar to traditional term life insurance plans, term plans with money-back benefits provide policyholders and their beneficiaries with four tax advantages.

Under Section 80C of the Income Tax Act, you can claim a tax deduction of up to ₹1.5 lakhs for premiums paid towards the plan. Additionally, Section 10(10D) exempts death and maturity benefits offered by the term plan with premium return plan from taxation.

Why Should you Consider Term Plan with Premium Return?

Financial security is a top priority, but building wealth is important, too. Term plans with premium return can help you achieve both goals. Here are some reasons why you should consider a term plan with premium return.

-

Build Wealth and Get Protection

Managing finances can be challenging due to rising living costs, debt, and healthcare concerns. A term plan with premium return offers a unique solution: they provide life insurance coverage while also returning your premiums if you survive the policy term.

-

Final Support for Your Loved Ones and Yourself

A term plan with premium return is ideal for those who prioritise both protecting their families in case of their death and receiving a return on their investment. If you pass away during the policy term, your beneficiaries will receive a payout.

-

Enhanced Coverage with Optional Riders

Many insurance companies offer riders that add additional benefits to your base term plan with premium return policy for a small extra premium. Here are some common rider options:

- Critical Illness Rider

- Waiver of Premium Rider

- Accidental Death Benefit Rider

- Accidental Total and Permanent Disability Rider

Choosing the Right Term Plan With Return of Premium

Term plan with premium return offers a compelling combination of life cover and potential returns. However, it’s important to consider your individual needs and financial goals before making a decision. Here are some factors you should keep in mind:

-

Cost Comparison

Term plans with premium return typically have higher premiums than traditional term insurance plans due to the return of premium benefits.

-

Policy Features

Carefully compare plans from different insurers to understand the premium amount, policy term, sum assurance, maturity benefits, and claim settlement process.

-

Financial Goals

Consider if term plan with premium returns align with your financial goals. If your primary focus is maximising life cover at the most affordable rate, a traditional term plan might be sufficient.

However, if you also want a guaranteed return on your premiums or are saving towards a specific long-term goal, a term plan with premium return can be an attractive option.

Peace of Mind, Plus Potential Returns

A term plan with premium return offers dual benefits under a term single plan. By understanding the advantage and carefully considering your financial needs, you can determine if it is the right fit for your financial portfolio.

A reputable insurance provider like Tata AIA offers a variety of term plans. They are known for their competitive rates, comprehensive coverage options, and excellent customer service. Explore their term plans with premium return to find a policy that aligns with your requirements and provides peace of mind for you and your loved ones.

Also Read: IPO Grey Market Premium, Latest IPO GMP & Kostak Rates – IPO Watch