Introduction

In 1990, India was staring at a baseline of less than one billion USD. After two decades, India, as a destination, is second only to China in terms of Foreign Direct Investment (FDI). The sectors which attracted capital inflows were Financial services, including Capital markets, the service industry, telecommunication, infrastructure, and IT industry. Initially, countries like the USA and UK, Singapore, and Mauritius were leading the FDI in India (Finance) investment, but now even countries like the oil-rich Saudi Arabia are keen to invest in India.

The impact of FDI in India resulted in key benefits such as economic growth in almost all sectors like opening up new markets, job creations, and high employments. The positive effects of FDI in Indian economy were felt through the transfer of technology and other intangible assets from MNC’s, leading to productivity, better efficiency of resource utilization, and higher per capita income today than earlier.

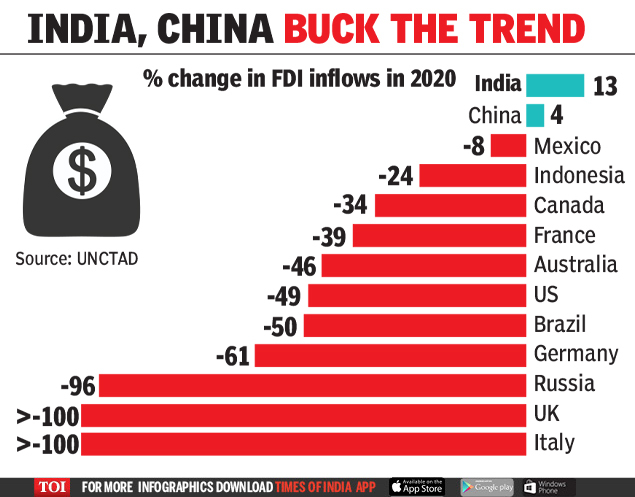

Even during the pandemic, India was an attractive destination for FDI with a record $25 billion inflow in the second quarter alone in 2020. Overall, in 2020, India witnessed a 13 % growth in FDI, whereas other major economies declined strongly.

So How Did India Buck The Trend?

The year 2020 was an aberration for investments globally. Still, India was already witnessing rising FDI inflows for the past four years. The momentum continued on the strength of a stable government, economic reforms, a high domestic demand, and a young workforce. The reason for the continuous rise in FDI in India was that the country’s macro fundamentals improved, inflation was kept in control, and economic growth was around 6-7%. This made India the fastest-growing economies in the world.

Foreign investors were betting on India for long-term investment. The country spelled out hope for MNC to increase their revenues through lower labor costs, a massive population, and the scaling up economies in tier 2 and tier -3 cities. Plus, many government initiatives such as increasing FDI investment in the insurance sector from 49% to 74% coming as a significant boost for foreign investors.

Relaxation In FDI Norms

The government of India came out with a slew of measures to infuse foreign capital into the Indian economy. Many critical areas were reformed, leading to

- Allowing real estate broking services to avail 100 % FDI through automatic route and without any government approvals.

- Faster approval of FDI proposals within ten weeks of application.

- 100% FDI in single-brand retail through automatic route.

- Increase in FDI in defense to 74 %, up from 49 % and through automatic route.

The Role Of Foreign Capital In The Indian Economy

Foreign capital provides the much-needed foreign exchange through the FDI route. Developing countries like India require foreign capital from various channels such as Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI). This includes funds raised by Indian corporates through Global Depository Receipts (GDR’s) and American Depository Receipts (ADR’s).

Countries like India have a domestic capital that is inadequate for the targeted economic growth. Here the foreign capital fills in the gap that arises out of domestic savings, foreign exchange, government revenues, and the projected investment required for development projects. A case in point concerning savings and investment gap.

For example, the GDP growth is targeted at 7 %. The capital output is 3%, then savings are required at 21 %. Assuming domestic savings, including government, revenues is 16%, then there is a gap of 5%, which is what the foreign capital fills in. Even after FDI investment, there is a shortfall. In the ordinary course, the government tries to raise additional funds by taxing the foreign enterprises operating in the country.

The role of foreign capital in Indian economy played a vital role in plugging gaps in management, entrepreneurship, technology, and skill enhancement. Not only did they bring in their superior expertise for developing infrastructures in various sectors, but they also contributed to the creation of productive assets and employment generation for the vast population of India.

Employments For A Young Population

With nearly 47 % of the population below the age of 25, the country has a young population that is active but productive for a long time compared to other countries. Another attraction for foreign investments is that India has a cheap labor force. This lower cost of arbitrage is a major factor for driving FDI into India.

Massive Market Size

India is a continent that masquerades as a country. Because it is not a fully developed nation, it has a vast growing and consuming middle class. This is a major incentive for foreign MNC ‘s to see India as a massive opportunity since other developed countries have already reached a saturation level. Companies like Walmart, Apple, Amazon, Aramco are looking at India as having a purchasing power potential because of the size of its economy.

The Impact Of FDI In The Insurance Sector In India

The Banking and insurance sector was second after the service sector to benefit from FDI investment in India post the globalization and liberalization reforms in the early nineties. Since then, investments have only increased. Even the great recession in 2008, which led to crashes in the banking and financial sectors, could not affect India. The country had a robust internal market that kept producing goods and services for its population. The remittances kept flowing, and so did foreign investment.

Coming to the impact of FDI in the insurance sector in India, the landmark changes first happened in early 2000. Only India’s state-owned life insurance (LIC) and the four Non-General Insurance companies did business in India. The opening up of the economy in the insurance sector led to foreign participation. Today, India has around 52 insurance companies, out of which 24 are in the life insurance business and 28 in the General Insurance business. This is also not adequate for India’s country. Apart from them, only five insurance companies are operating exclusively in Healthcare insurance.

An Underinsured Country

The insurance sector has grown quickly in India, with a total first-year premium in the life insurance segment reaching 2.59 lac crore INR or $37 billion in the FY 2020. However, this translates into an insurance penetration of only about 3.7 % of the GDP compared to the global average of 6.31 %. When one extrapolates these penetration figures with the corresponding Indian population, one can imagine the kind of market that is still to be tapped.

No wonder the Indian government raised the FDI limit to 74%. This will give the much-needed impetus to improve the digital and physical infrastructure, recruit a skilled workforce, design products suitable for the large under-income and rural population. A study by IIM, Indore, pointed out that with increased FDI in India, the breakeven for insurance companies will lessen to five years from the current eight years.

A Level Playing Field

With the government raising the limit to 74%, more global reinsurance companies are expected to open branches in India. This will lead to healthy competition between the insurance players. The benefit would ultimately accrue to the end consumer. They will get competitive premium quotes, improved services, and a better claim settlement ratio. A vibrant insurance sector would also help support long-term investments in infrastructure products as they tend to have a longer gestation period. This will reduce the burden on banks and NBFC’S.

Josie Patra is a veteran writer with 21 years of experience. She comes with multiple degrees in literature, computer applications, multimedia design, and management. She delves into a plethora of niches and offers expert guidance on finances, stock market, budgeting, marketing strategies, and such other domains. Josie has also authored books on management, productivity, and digital marketing strategies.