Financial flexibility is important for every individual. Traditional loans, with their lengthy paperwork and long approval processes, can be inconvenient, especially when the rigid lending criteria doesn’t align with your needs. There are often moments when you need urgent access to cash but your monetary requirements may be below the minimum limit set by banks for loans or you may not have the time to go through the lengthy application process. A credit line offers a solution to these problems.

So, what is a credit line?

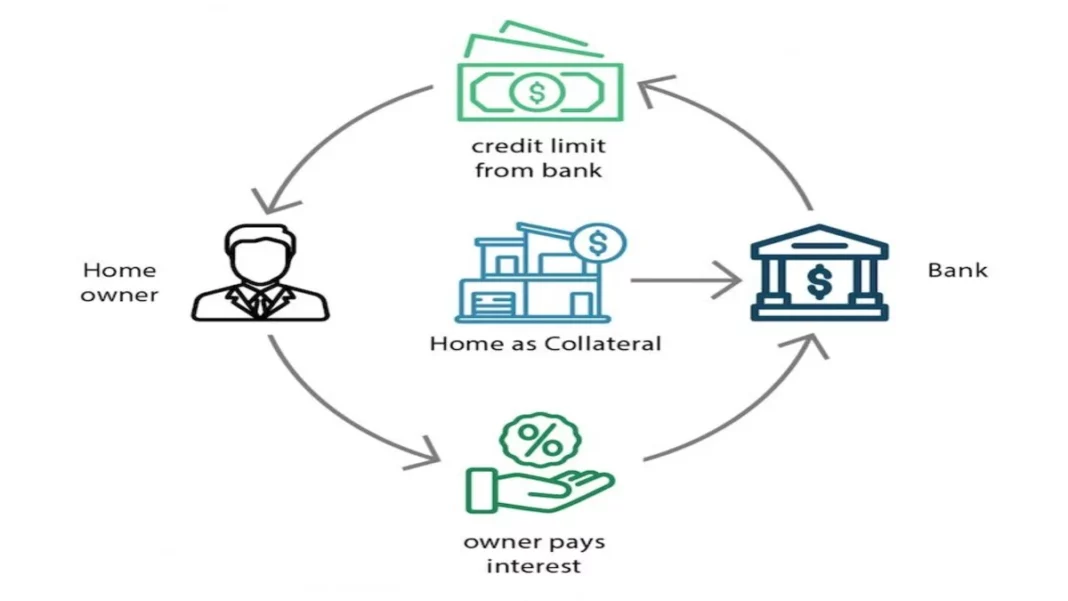

A credit line, also known as a Line of Credit (LOC), is a preset borrowing limit where you are approved for a maximum loan amount. It offers high flexibility as you do not have to use the full amount all at once. Instead, you can borrow the amount whenever you need and only pay interest on the amount you actually use.

You can repay the borrowed money in monthly instalments, and once it’s fully repaid, the entire credit line becomes available again for use.

Features and benefits of using a credit line

An easy credit online facility offers a world of convenience and benefits. Have a look at some of the notable advantages below:

1. Easy to apply and avail a high credit limit

When you choose INDIE’s My Credit Line by IndusInd Bank, you can borrow up to ₹5 lakh anytime, multiple times. This high credit limit means you have substantial financial backing to manage expenses without delay. You can use the funds to:

- Fund a dream vacation

- Plan a birthday event

- Undertake home renovation projects

- Buy expensive electronics

- Invest in professional courses

- Buy a new vehicle

Simply open an INDIE Savings Account, choose the ‘Instant Line of Credit’ option, and complete your VKYC (video KYC) if necessary. Then, you can use the credit as needed and repay it according to a schedule that suits you.

2. Revolving credit

A credit line is often structured as revolving credit, which means that once you repay the borrowed amount, the funds become available again to borrow. This cycle can continue over the life of the credit line and provide you with continuous access to funds.

This feature is highly useful for handling everyday expenses or irregular cash flows that can occur with seasonal businesses or freelance work.

3. Interest rates and payments

Interest on a line of credit is calculated based on the amount withdrawn, not on the total limit. This can help you save more money on interest payments compared to fixed-term loans. Not only this, but you can repay the borrowed sum at your convenience. Simply decide on a payment schedule that works best for your budget.

4. Have 24/7 accessible emergency funds

The very nature of a credit line, being pre-approved and revolving, means that funds are always available without lengthy approval processes. This benefit makes it an ideal source of emergency funds. You do not have to pay interest unless you borrow, but the funds are always accessible if needed.

This is critical during time-sensitive situations like medical treatment, sudden home repairs, or urgent business expenses.

5. Improves credit score

Managing a line of credit responsibly can help you build your credit profile. Each on-time payment is a positive mark on your financial record and reflects your reliability in managing debt. This is more beneficial if you are looking to apply for larger loans in the future, as lenders will note your punctual payment history.

Key takeaways

A credit line is a versatile borrowing option that helps you cover expenses that your budget can’t handle. From managing cash flow gaps and big-ticket purchases to improving your credit score through punctual repayments, the benefits of this financial lifeline are countless.

Just make sure to go through the credit line fees and other aspects like interest rates, repayment terms, and any additional charges that might apply. Understanding these details will help you maximise the benefits while reducing costs.