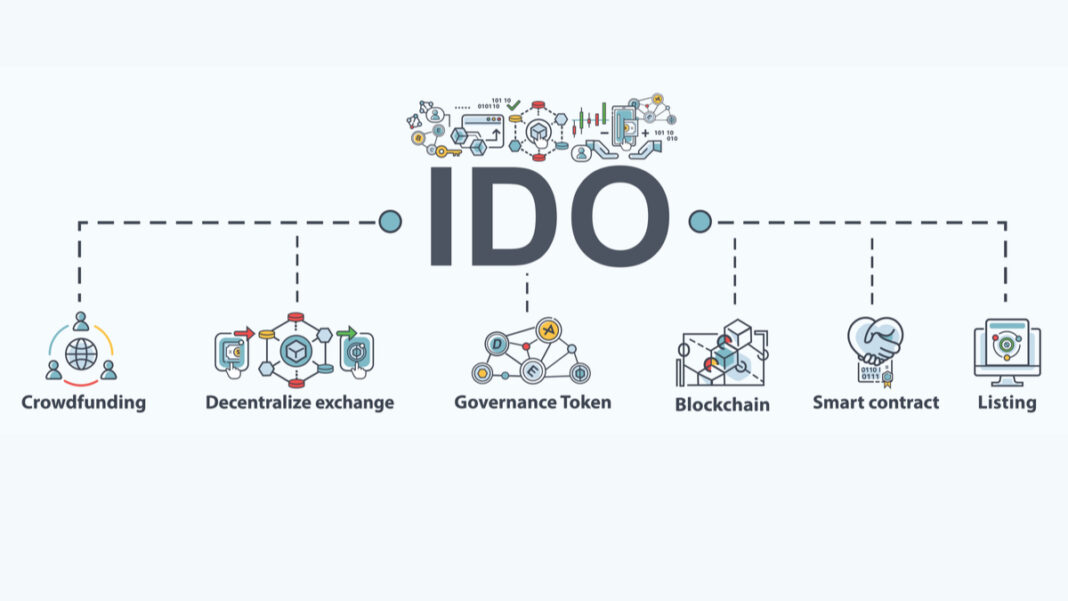

An IDO is a decentralized exchange-based crypto token offering (DEX). Liquidity pools are essential in IDOs because they provide liquidity after the sale. A typical IDO allows users to lock assets in exchange for new tokens during the token generation event. Some of the monies generated are added to an LP with the new ticket.

IDOs allow projects to issue their tokens cost-effectively and straightforwardly. Although IDOs have been there for a while, they continually evolve and offer new models, such as Initial Farm Offering (IFO). As the industry gets more regulated, we may see increased KYC requirements.

Introduction to IDO

A token issue is typically a fantastic prospect for investors in the crypto industry in the crypto industry. Having the opportunity to purchase a token there at launch price could be incredibly beneficial. This, however, is only one side of the story. Looking back on the ICO (Initial Coin Offering) mania on Ethereum (ETH) in 2017, it wasn’t good. Frauds and rug pulls were common, and investors often lost a lot of money. Since then, the crypto industry has established other token issuing mechanisms such as Initial Exchange Offering (IEO), Initial DEX Offering (IDO), & Security Token Offering (STO).

What is token offering?

The token offering is indeed a way of raising funds in which a project or firm sells a new coin. Crowdfunding solutions include using a centralized ido crypto exchange platform to administer the process (IEO), collaborating with such a local financial regulator (STO), as well as going it alone (STO) (ICO). Some investors buy coins for their utility, while others buy them for speculation.

How does IDO work?

An IDO utilizes a decentralized exchange (DEX) to enable the token sale. The DEX receives a crypto project’s tokens, users contribute funds via the network, and the DEX completes the ultimate distribution and transfer. These processes are fully automated and run on the blockchain using smart contracts. The criteria and phases of an IDO are determined by the DEX that is running it, although there are a few popular approaches:

- After a verification process, a project is approved to operate an IDO on just a DEX. They provide a fixed amount of tokens for a specific price, and users exchange their funds for these tokens. The tokens will subsequently be distributed to investors during a token generation event (TGE).

- There is usually an investor whitelist. To join the list, one may be required to execute marketing chores or supply a personal wallet address.

- A portion of the funds will be utilized to establish a liquidity pool using the project’s token. The remaining money is distributed to the team. After the TGE, investors can trade the token. The offered liquidity is usually locked for a set length of time.

- The tokens were delivered to the user at the TGE, and the LP was made available for trading.

Also Read: Takung Art Stock – Should You Invest in It?