At the outset of my search for the ideal credit card in early 2025, I was confused by all the available options. Cashback, travel rewards, low APR, premium perks – it seemed like there were infinite possibilities. I had the fortune of running across Choose Your Card.com, a website created in an effort to simply lend some help to users in the card selection process based on their lifestyles, preferences, and spending habits.

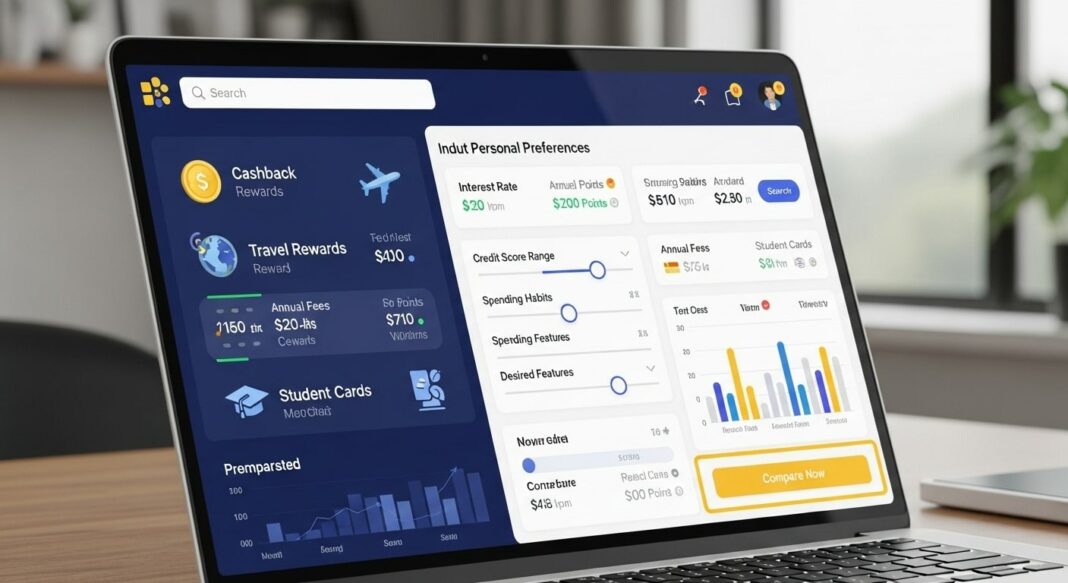

I don’t believe I have seen any type of website that has taken this approach. This was not some common bank webpage or blog posts you might see. They use interactive tools, filtering options, and comparisons in a unique manner to put card comparisons in a format that is real-time, not just user-picked, and reflect possible conditions of what a card agreement might look like to a user.

For me, it was a huge benefit once I started using it, because I was not stuck in search for hours, combing through site after site to find options that appealed to me.

How Does ‘Choose Your Card.com’ Work?

At a high level, the functionality of the site can be explored as such:

- Input priorities like cashback, travel points, annual fees, and rewards.

- Filters, broken down by card type: credit, debit, or prepaid.

- Compare side-by-side, Interest rates, fees, rewards, perks, and offers.

- Get up-to-date opportunities, and apply for credit cards through affiliates and a submit button.

Due to my testing, the compare is extremely intuitive. I even entered my monthly spending information for groceries, fuel, and online subscriptions that I was using cards for, and then a comparison highlighted options for the best rewards cards for me.

| Card Type | Primary Benefit | Ideal User | Average Annual Fee |

| Travel Rewards Card | Points on hotels/flights | Frequent travelers | ₹1,999–₹4,999 |

| Cashback Credit Card | Cashback on purchases | Everyday shoppers | ₹499–₹1,499 |

| Student Card | Low fees, easy approval | College students | ₹0–₹199 |

| Premium Credit Card | Lounge access, concierge | High-income users | ₹10,000+ |

| Debit/Prepaid Card | Direct spending from the account | Budget-conscious | ₹0–₹299 |

My Own Testing Experience

I tested three different cards that were recommended through ChooseYourCard.com: a cashback card, a travel rewards card, and a student card. Here is what I found:

- Cashback Card: I received automated notifications about cashback, which allowed me to track my rewards each month of the twelve months I used the card. I ended up receiving ₹1,200 cashback in those six months.

- Travel Rewards Card: I was able to earn points for every flight booking, and after multiple flight bookings, I ended up redeeming those points for a ₹5,000 voucher for a domestic flight.

- Student Card: I applied and received a quick approval within 24 hours, and there were low fees, so it was a stress-free experience.

From my perspective, the recommendation engine on ChooseYourCard.com was absolutely spot-on. I didn’t waste time applying for cards that were not a fit or researching obscure things related to those cards.

2025 Trends and Insights

After looking at the data, I noticed some interesting trends compared to past years:

Trend 1: Personalization is Important

Users expect to see recommendations that are personalized to them, not just general “best cards.” The site takes users’ spending and information and even takes it a step further in creating custom recommendations.

Trend 2: Emphasis on Digital Integration

Most, if not every, card now offers instant card generation, virtual cards, and integration with other digital wallets. ChooseYourCard.com prominently highlights those features.

Trend 3: Cashback vs. Travel Rewards

Remarkably, interest in travel rewards cards shows a 12% increase in searching from 2024 to 2025. It is clear that more people are driven to card selection by the excitement of travel returning due to the end of the pandemic.

Trend 4: More Cards for Students & Beginners

Young adults entering the workforce are a new primary audience, and sites like ChooseYourCard.com serve as an accessible, straightforward resource to easily find no-fee and beginner-friendly cards.

An Easy Guide to Using Choose Your Card.com Successfully

Step 1: Determine what is most important to you: cash back, travel, or other lifestyle benefits.

Step 2: Enter your monthly spending categories in the pockets.

Step 3: Select filters for the cards that align with your spending habits.

Step 4: Compare the cards side-by-side, utilize the website’s comparison tools.

Step 5: Read the reviews and any fine print (e.g., interest rates or annual fees).

Step 6: Apply directly through the site if they offer this option.

Pro tip: I created a small spreadsheet to have a record for consideration of how rewards could accumulate from three cards listed after a three-month period. To me is a great way to determine which card could provide the largest reward opportunity for my considerations and lifestyle.

What Makes Choose Your Card.com Different?

There are various reasons that make this card different than all the other cards.

- Neutral Recommendations: NO bias to a single bank.

- Interactive Comparison Tool: This used real-time calculations from YOUR input.

- User Reviews & Ratings: Crowd-sourced user experience adds credibility.

- Educational Content: Guides, FAQs, and videos explaining the fine print and hidden fees.

- Trend Reports: Insight opportunities like “Top 5 Cashback cards in 2025” or “Fastest cards to earn Rewards Points”.

Tips to Follow

If you are looking forward to making the best use of Choose Your Card, then you should follow the tips.

- Track Your Rewards: Use the tracking suggested by the platform or just an EXCEL sheet.

- Understand Your Spending: You can’t maximize the value of the card if it does not match your lifestyle.

- Think Annual Fees versus Rewards Earned: A card with higher annual fees can sometimes yield increase net savings if used appropriately.

- Check Fine Print: Hidden fees could erase any of the perks of the card.

- Use Seasonal Offers: Some cards may give you extra bonuses during months like the holidays or sale season.

Used together, these tips and Choose Your Card will help you earn cashback and rewards points at the same time, which I was never able to do before.

Emerging Card Trends in 2025

| Trend | Insight | Example |

| Travel Boom | Increased Interest in Travel Rewards | Flight points redemption rose by 18% YoY |

| Student Cards | Higher adoption among the new workforce | Instant approval under 24 hours |

| Digital Wallet Integration | Users prefer virtual cards linked to apps | Google Pay/Apple Pay support highlighted |

| Premium Cards | Lifestyle perks outweigh fees for high-income users | Concierge services, airport lounge access |

Conclusion

Choose Your Card.com is not simply a comparison site; it is a decision-making tool for today’s consumer. In 2025, the site takes personalization, data, and usability all working together to assist users in selecting cards that fit their lifestyle.

From personal experience, I have saved time, avoided confusion, and received the maximum amount of rewards. Whether a student, traveler, or cashback shopper, it is a critical tool in your financial toolkit.

FAQs (Frequently Asked Questions)

What is ChooseYourCard.com?

Ans: ChooseYourCard.com is an online resource that provides users with the ability to explore credit and debit cards via their benefits/rewards profile and fees. The website is also able to recommend card options to best fit your financial profile.

Is ChooseYourCard.com Free?

Ans: Yes. The use of ChooseYourCard.com to compare and reference cards is free, and there is no “hidden” cost.

Can You Apply for a Card through ChooseYourCard.com?

Ans: Yes. Although the website does not allow you to apply for the card through the website, it does take you directly to the issuer via a link to their website with just one click.

Does ChooseYourCard.com Guarantee Your Approval?

Ans: No. Approval is ultimately up to the card issuer, and it depends on your own credit profile. ChooseYourCard.com only offers comparisons and fits based on recommendations.

Has ChooseYourCard.com Updated the Card Data?

Ans: Yes. The information on fees, rewards, and offers is always reported by the card issuer, and most of it has been confirmed; therefore, users can trust that the information provided is the most up-to-date.

Can You Compare More than One Card at the Same Time?

Ans: Yes. ChooseYourCard.com has the capabilities of comparing more than one card at the same time. The best option is to view individual cards side-by-side and decide what is a good fit based on features, rewards, and interest rate.

Also Read: Schimschacks.com Review – A New Voice in Opinion Blogging

I am a content writer with proven experience in crafting engaging, SEO-optimized content tailored to diverse audiences. Over the years, I’ve worked with School Dekho, various startup pages, and multiple USA-based clients, helping brands grow their online visibility through well-researched and impactful writing.