Introduction

Income Tax and Income Tax Returns (ITR) are two essential aspects of the Indian taxation system. Every citizen, irrespective of the job type, must file these to fulfill their obligation to the government. Hence, it is also crucial to understand the core difference between ITR filing and income tax.

Even though these two terms may sound alike, they hold different meanings and importance. Not knowing the right difference can lead to mistakes that eventually cost huge amounts of money.

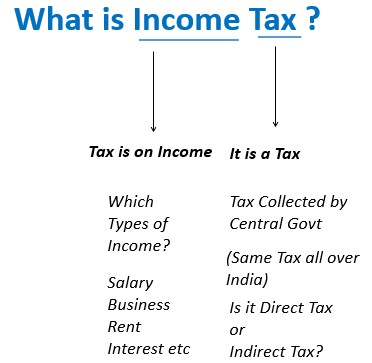

What is Income Tax?

Every person that earns income has to pay income tax to the central government. The central government has made slabs, and according to those slabs, people who exceed the minimum threshold will have to pay income tax to the government. The central government collects income tax as per the income tax act of 1961, which powers them to collect the tax from citizens in India.

As per the latest government guidelines, an individual can go for either the new or the old tax regime for an income tax deduction. The two have different slabs and minimum thresholds, and the income tax will be deducted based on the individual’s preferred choice.

Additionally, the central government also holds control of making changes in this act through the union budget that happens annually. But the mistake people make is not understanding the term income. Income does not only mean what you get from your job or business. There are different aspects included in the word income. Below are different income sources; if you still have confusion, you can go for an online tax consultant to solve your queries.

Income Sources

- Any professional gain, such as a bonus

- Rent you receive from commercial or residential property

- Any profit from business

- Capital gains from every investment

- Any income you receive from sources such as loyalty, dividend, or lottery

What is Income Tax Return (ITR)?

Income tax is paid on the income made by an individual, but an income tax return is filled out by the end of the financial year to assess the total income. ITR filing happens every financial year; you can do it without income. The Income tax return filing form will have all the information about your income & the tax deducted by the government.

With the help of ITR tax filing, you will also check whether you have an excess tax or less compared to what was required. In case of an excess tax, the money will be refunded, and you will have to pay the remaining amount in case of less.

The central government notifies the ITR filing last date, and individuals and businesses are supposed to comply with the same. If they cannot do ITR filing by that specific date, consequences and penalties can be attached to their action.

What is the Difference between ITR Filing and Income Tax?

Let’s understand the difference between ITR filing and income tax through this simple table:

| Income Tax | Income Tax Returns |

| It is the amount an individual needs to pay as a tax on their earnings in that particular financial year. | ITR is the annual record of all the income you made in the financial year. |

| The individual’s tax liability is calculated per their income and the tax slab they fall under. | ITR depends on the factors such as tax liability, annual income, investments, and tax paid. |

| Other contributing factors to income tax calculation are savings, investments, rebates, and deductions. | ITR contains all the relevant information that the government needs to assess your income and tax. |

To Wrap it Up

Understanding the difference between ITR filing and income tax is needed to navigate the complex world of taxation. An income tax return is a form that one must fill with information on total income and deductions. Hence, it is essential to file it regularly.