Investing in a company with fewer revenues and profits may be a big draw for a few investors, as they love experiencing a reverse on a company’s fortune. They may invest in such a company out of emotions and not with merit. But, investing in companies like Indian Energy Exchange (IEX) is a wise idea as they have profits and revenues. If the company continues to gain profits, iex share price will offer shareholders long-term value.

Why should you keep watching iex share price?

All the companies which experience growth in their earning per share or EPS generally see a similar trend in their share prices. This is why investors buy shares of companies growing in EPS. As far as IEX is concerned, the company has consistently increased its EPS by 23% per year for the last three years. This trend makes iex share price an alluring stock to watch out for, and sustainable growth will satisfy the shareholders.

A company can manage an advantage in the competitive market with top-line growth and high earnings before interest and taxation margin (EBIT). The revenue of IEX grew by 3.7% to Rs.4.7b last year while it achieved similar EBIT margins.

Investors always look for prospects in a company’s stock trends, and the share price of iex is no exception.

iex share price nse

IEX is the leading energy marketplace in India and expanded its power market outside India to build an integrated market across South Asia. The company has an automated trading network to deliver power and renewables.

iex share price nse and BSE have been listed in October 2017.

Predictions for IEX shares

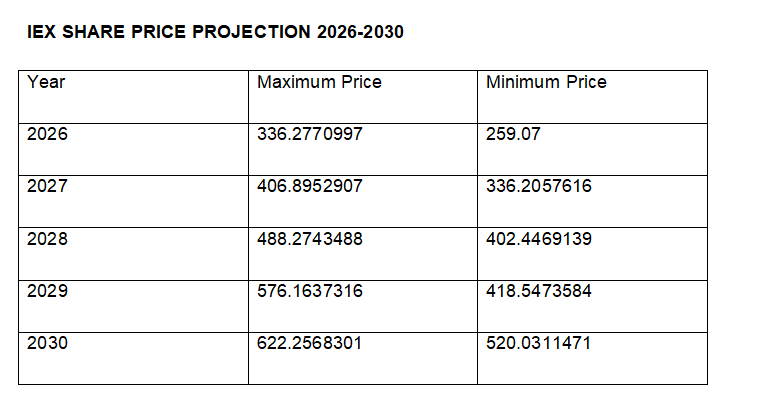

This article forecasts shares targets up to 2030, which will seemingly reach Rs.622.25.

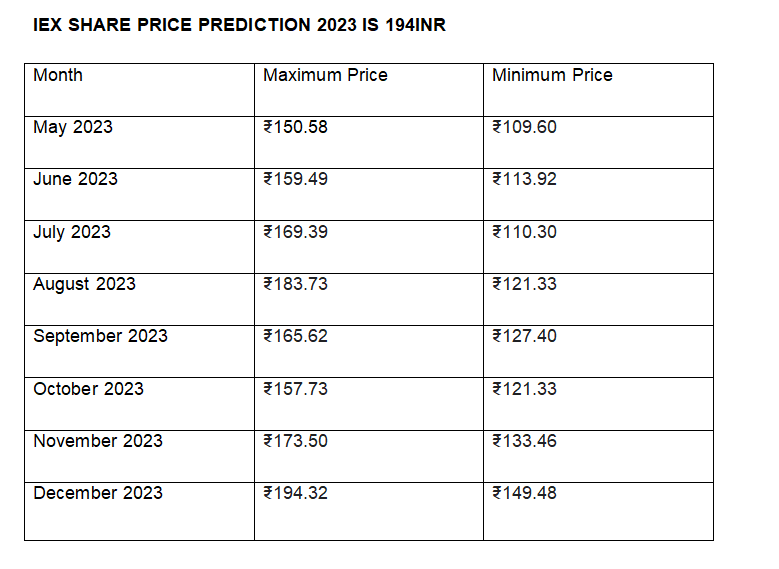

However, if you need a chart of IEX stock prediction for the rest of 2023, here it is:-

As the forecast suggests, the share price of iex may fall around July 2023, and it will not possibly see growth in August 2023 either. But, from September, it’s probably going to rise again.

As the forecast suggests, the share price of iex may fall around July 2023, and it will not possibly see growth in August 2023 either. But, from September, it’s probably going to rise again.

As a good market indicator, the profit margin and net profit of IEX have been growing, leading to the overall consistent growth of the company. Therefore, IEX has become not only a crucial stock to keep an eye on but also a must-buy for long-term investors.

What happens to iex share price nse in 2024 and 2025?

Despite having ups and downs, IEX shares will be a reason for prosperity for the investors. The year begins with the share price rising to Rs.200, and it will see a further hike up to Rs.272 in December 2024. While May and July 2024 will see a downfall, it will still not go down 180, which is entirely up to the average price 2023.

January 2025 will pick the price up from exactly where December 2024 left it. The investors will gain an expected capital growth in 2025 with IEX shares as its costs will not be less than Rs. 250 for the whole year if it doesn’t reach Rs.300. The IEX share price predictions for June 2025 is as high as Rs.292.97.

iex share price target 2030

IEX share price, starting from forecasts of 2026, will help you understand why the company has become an asset for the shareholders.

So, the iex share price target 2030 is 622.25, which is the reason for all the anticipations, analysis and predictions.

How to buy IEX shares?

You can buy IEX shares in India via several platforms such as:-

- Upstox

- Zerodha

- Groww

- ICICIDirect

- AngelOne

Final Words

Evidently, iex share price is very much worth buying at this time, as it’s going to grow up to Rs.600 in the upcoming years. All you need to do to be a part of the company’s financial growth is to buy its shares and follow the market trends regularly. Though there are a few ups and downs, it’s mostly going upwards, making it a good buy for long-term investors.

Also Read: trident share price Target