State Bank of India (SBI) Overview and SBI share price

The State Bank of India (SBI) is the largest and oldest public sector bank in India. Established in 1806 as the Bank of Calcutta, it was later renamed the Bank of Bengal in 1809. The bank underwent a series of transformations, becoming the Bank of Bombay and the Bank of Madras, before finally merging into the Imperial Bank of India in 1921. In 1955, the Reserve Bank of India took control of the Imperial Bank of India, and it was subsequently renamed the State Bank of India. Keep reading to explore about SBI share price.

SBI operates as a full-service financial institution, providing a wide range of products and services to retail, corporate, and institutional clients. These services include personal banking, agricultural banking, corporate banking, SME banking, NRI services, and international banking. The bank offers various types of accounts, loans, credit cards, insurance, pension schemes, and investment services.

As the largest bank in India, SBI has a vast network of branches and ATMs across the country, with a significant international presence as well. It has branches, representative offices, or subsidiaries in several countries around the world. The bank is known for its strong market presence, solid capital base, and efficient management. SBI is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) in India, and it also has a sponsored ADR listed on the New York Stock Exchange (NYSE).

SBI has played a crucial role in the development of the Indian economy, supporting various sectors and industries, and financing infrastructure projects. The bank has a strong focus on financial inclusion, ensuring banking services are accessible to the unbanked and underbanked population of India. As a government-owned entity, SBI is committed to fulfilling the social and economic objectives of the Indian government, while maintaining profitability and operational efficiency.

Analyzing the Business Model of State Bank of India

State Bank of India (SBI) is the largest and oldest public sector bank in India. Established in 1806 as the Bank of Calcutta, it was later renamed Bank of Bengal in 1809, and eventually became the State Bank of India in 1955. SBI has a vast network of branches and ATMs across India and in several other countries. The bank’s business model can be analysed by looking into its key components:

1. Revenue Streams: SBI earns revenue through multiple channels, including:

2. Interest Income: Generated from loans and advances to retail customers, businesses, and other financial institutions.

3. Fees and Commissions: Earned from various services such as account maintenance, remittance services, trade finance, and card services.

4. Investment Income: Profits from the bank’s investments in securities, bonds, and other financial instruments.

5. Forex Operations: Income from foreign exchange transactions, remittances, and other services related to international trade.

6. Asset Management: Revenue from managing investment products, including mutual funds and insurance.

7. Customer Segments: SBI serves a wide range of customer segments, including:

8. Retail Customers: SBI offers savings and current accounts, loans, insurance, and investment products to individuals.

9. Small and Medium Enterprises (SMEs): The bank provides working capital, term loans, trade finance, and other financial services to SMEs.

10. Large Corporations: SBI offers corporate banking services, such as project finance, working capital, trade finance, and cash management solutions.

11. Government and Public Sector: SBI serves government institutions and public sector organizations by providing them with banking and financial services.

12. Non-resident Indians (NRIs): The bank offers specialized services to cater to the unique financial needs of NRIs.

13. Core Products and Services: SBI offers a wide variety of banking and financial products and services, including:

14. Deposits: Savings accounts, current accounts, fixed deposits, and recurring deposits.

15. Loans: Home loans, personal loans, car loans, education loans, and loans against property.

16. Cards: Credit cards, debit cards, and prepaid cards.

17. Insurance: Life insurance, health insurance, and general insurance.

18. Investments: Mutual funds, fixed income securities, and other investment products.

19. Digital Banking: Internet banking, mobile banking, and digital wallets.

20. Distribution Channels: SBI uses multiple channels to deliver its products and services:

21. Branch Network: SBI has a vast network of branches across India and abroad, which act as primary points of service for customers.

22. ATMs: SBI operates a large number of ATMs, providing convenient access to banking services.

23. Digital Platforms: The bank offers internet and mobile banking services, enabling customers to access their accounts and transact online.

24. Business Correspondents: SBI partners with business correspondents to extend its reach in rural areas and offer basic banking services to the underbanked population.

25. Partnerships: The bank collaborates with various partners such as insurance companies and fintech companies to offer complementary products and services.

26. Competitive Advantage: SBI’s competitive advantage lies in its strong brand recognition, extensive branch network, diverse product offerings, and deep penetration in both urban and rural markets.

In summary, the State Bank of India operates a diversified business model, catering to a wide range of customer segments with a comprehensive suite of financial products and services. Its extensive reach and strong brand recognition have helped it maintain its position as India’s leading public sector bank. Knowing about SBI bank share price will be beneficial for you.

SBI Services

State Bank of India (SBI) is the largest public sector bank in India. It offers a wide range of banking and financial services to individual, corporate, and government customers. Some of the key services provided by SBI include:

1. Savings Accounts: SBI offers various types of savings accounts, such as regular savings accounts, youth savings accounts, and premium savings accounts, each catering to different customer segments.

2. Current Accounts: SBI provides current accounts for businesses, allowing them to manage their day-to-day transactions more efficiently.

3. Fixed Deposits and Recurring Deposits: SBI offers fixed deposit and recurring deposit schemes with attractive interest rates and flexible tenures.

4. Loans: SBI provides various types of loans, including home loans, car loans, education loans, personal loans, and loans against property.

5. Credit Cards: SBI offers a range of credit cards with different benefits, such as cashback, rewards, and travel benefits.

6. Insurance: SBI provides life, health, and general insurance products through its subsidiaries and joint ventures, such as SBI Life Insurance, SBI General Insurance, and SBI Health Insurance. You must know about SBI life share price.

7. Mutual Funds: SBI offers a variety of mutual fund schemes through its subsidiary, SBI Mutual Fund.

8. Demat and Trading Accounts: SBI provides demat and trading accounts for customers to invest in stocks, bonds, and other securities through its subsidiary, SBI Cap Securities.

9. NRI Services: SBI offers specialized banking and financial services to Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs).

10. Mobile and Internet Banking: SBI provides digital banking services through its mobile app (YONO SBI) and internet banking portal, allowing customers to access their accounts, transfer funds, pay bills, and more.

11. UPI and Wallet Services: SBI supports Unified Payments Interface (UPI) and offers its own digital wallet service called SBI Buddy for quick and easy transactions.

12. Forex Services: SBI offers foreign exchange services, including currency exchange, remittance, and travel cards.

These are just a few of the many services provided by SBI. The bank continually innovates and expands its offerings to cater to the evolving needs of its customers.

SBI Shares Overview

Stock information: Before exploring share price of SBI, you should have proper stock information.

- Stock symbol: SBIN (traded on the National Stock Exchange of India and Bombay Stock Exchange)

- Market capitalization: SBI is one of the largest companies in India by market capitalization, which may have changed since 2021.

The performance of SBI shares is influenced by various factors, such as:

1. Financial performance: SBI’s quarterly and annual financial results, including its revenue, net profit, non-performing assets (NPAs), and other key performance indicators, can significantly impact the share price. You must explore more about SBI card share price.

2. Industry trends: The overall health of the banking sector and the Indian economy, interest rate changes by the Reserve Bank of India (RBI), and regulatory developments can influence SBI’s share price.

3. Market sentiment: Investor sentiment and market perception of SBI’s management, business strategies, and growth prospects can also affect its stock performance.

4. Global economic factors: International economic events, such as changes in the global interest rates, currency fluctuations, and geopolitical developments, can impact SBI’s share price.

The current SBI share price is ₹ 552.40 per share as of April 24th 2023.

Disclaimer:

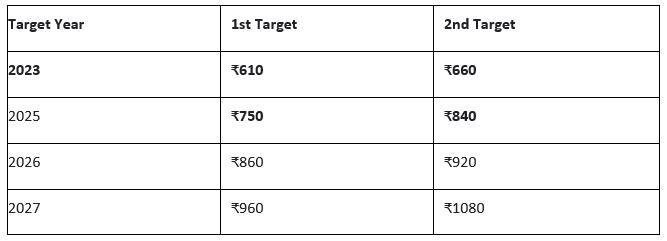

The provided price projections for “State Bank of India” are intended for informational purposes only and rely on favourable market conditions. These SBI Share price forecasts do not account for potential company-specific uncertainties or fluctuations in the global market landscape.

Also Read: What Is Cyber Hygiene, and Why Is It Crucial for Startups?