An education loan is a type of loan specifically designed to help cover education costs. Like other types of loans, education loans typically involve borrowing money and then repaying it over time, usually with interest.

Best education loans can come from various sources, including the federal government, private lenders, and even schools. The type of loan you qualify for will depend on factors like your credit history and income. Let’s see some of the best banks for education loans in India.

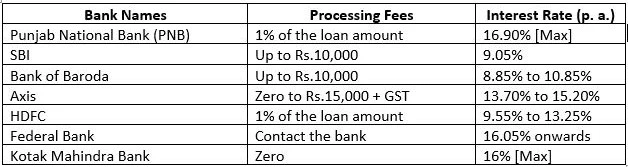

Best Banks for Education Loan

Eligibility for Taking Best Education Loan in India

-

Nationality

Indian citizens

Overseas Citizens of India (OCI)

Non-Indian Residents (NRIs)

Students who want to study in India and were born to Indian parents overseas

Persons of Indian Origin (PIOs)

-

Courses

Undergraduate programs

PhDs and Doctoral courses

Postgraduate programs

Certificate courses with 6 months or longer duration

Technical/professional/diploma courses

Job-oriented courses

-

Collateral

Collateral-free loans from reputable lenders up to Rs. 7.5 lakh

Collateral-free loans up to Rs. 40 lakh from selected lenders for specific programs and institutions

Acceptable collateral: Commercial or residential property or plot, insurance, fixed deposits

Loan amount: Up to Rs.1 crore

-

Documents

Mark sheets (preceding education – school/college)

Admission letter from the educational institution

Age proof

Address proof

ID proof

Signature proof

Recent bank account statements

Salary slips

ITR with income addition

Recent bank statements

Audited balance sheet

Proof of turnover

Latest passport size photographs

Completed application form with signature

Appropriate Visa for studies abroad

Importance of Finding the Best Bank for Education Loan

When you are planning to further your education, one of the most important things to consider is how you will finance your studies. An education loan can help you cover the cost of tuition, fees, and other related expenses. But not all banks offer the same terms and conditions for education loans. So it is essential to compare different banks and find the one best suits your needs.

Here are a few things to remember when looking for a bank for your education loan:

- The interest rate

- The repayment period

- The fees

- The collateral

- The loan amount

Choosing the best bank for your education loan can save money and help you get the financing you need to further your education. Be sure to compare different banks and choose the one that best suits your needs.

Also Read: The Importance of Mobile Insurance Companies in India