Each person has various preferences when it comes to saving. According to factors like the amount that can be saved, the length of time needed to keep, the goal of savings, and additional information, a person can select a different savings vehicle. Due to the fact that market fluctuations don’t impact them and carry an assured, constant interest rate, fixed deposit (FD) accounts have become a popular choice for conserving money. Under the Income Tax Act section 80C, tax-saving FDs enable you to invest money to reduce your tax liability. Under the Tax Savings Scheme, a term deposit must have a minimum tenure of five years. A tax exemption of up to Rs. 1.5 lakh is possible. Let’s talk more about rajkotupdates.news : tax saving pf fd and insurance tax relief .

Best Investments for Tax Savings:

- Fixed Deposit

- PPF – Public Provident Fund

- LIC – Life insurance

- NPS – New Pension Scheme

- EPF – Employees’ Provident Fund

- ELSS – Equity Linked Saving Scheme

- PPF – Public Provident Fund

Tax Exemption on PPF LIC Premium:

As per Section 80C of the Income Tax Act of 1961, investments up to Rs 1.5 lakh each fiscal year are totally tax-free for investors. Additionally, earnings from interest and maturities are tax-free as well. As a result, a person investing in PPF to save for retirement does not need to be concerned about taxes.

Tax Exemption for EPF:

Section 80C of the IT Act permits a deduction for an employee’s contribution to their EPF account up to a maximum of Rs 1.5 lakh. Moreover, EPF, NPS, and superannuation fund contributions that exceed Rs 7.5 lakh in a fiscal year will result in the employer’s contribution to the EPF account becoming taxable starting in FY 2020–21.

Tax Exemption on ELSS:

A mutual fund called ELSS enables you to deduct your income taxes. By engaging in ELSS, exempt from taxation under Section 80C of the Income Tax Act of 1961, you may save up to 1.5 lakhs in yearly taxes. However, you are free to make investments of more than 1.5 lakh rupees; nevertheless, doing so will exclude you from Section 80C’s tax benefits.

Tax Exemption for tax saving fd:

An account type, a tax-saving fixed deposit (FD) account, provides a tax deduction under Section 80C of the Income Tax Act of 1961. Additionally, by opening a tax-saving fixed deposit account, any investor can receive an annual deduction of up to Rs. 1.5 lakh. Some of its characteristics are:

- A five-year lock-in duration

- Income from interest is taxable.

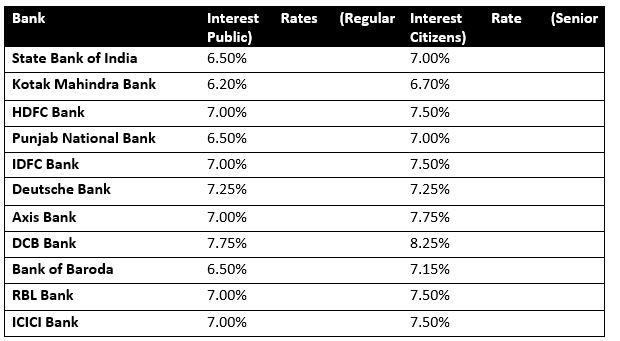

- The interest rate is between 5.5% and 7.75%.

Tax Exemption for NPS:

Only NPS subscribers are eligible for an extra deduction under subsection 80CCD (1B) for investments up to Rs. 50,000 in NPS (Tier I accounts). It is in addition to the deduction of Rs. 1.5 lakh permitted by Section 80C of the Income Tax Act of 1961.

Top 10 Tax Saving Fixed Deposit Schemes in India 2023:

Primary Features of Tax-Saving Fixed Deposits

- Tax Saver Fixed Deposits (FDs) offer the advantage of tax deduction under Section 80C of the income tax Act, allowing individuals to claim a deduction of up to Rs. 1.5 lakh on their taxable income. Moreover, this enables individuals to reduce their tax liability significantly.

- Tax Saver FDs have a mandatory lock-in period of 5 years, during which the deposited amount cannot be withdrawn. It ensures that the funds remain invested for a specified period, providing long-term stability.

- Tax Saver FDs provide a fixed interest rate for the entire tenure, shielding investors from fluctuations in market rates. Furthermore, it allows individuals to earn a predictable return on their investment.

- Tax Saver FDs can be opened with a minimum investment amount, which may vary depending on the bank or financial institution. Additionally, investors can choose an amount that suits their financial goals and budget.

- Opening a Tax Saver FD is a simple process, requiring individuals to submit the necessary documents and complete the application form. Moreover, the convenience and accessibility make it a popular investment option for individuals looking to s

We hope this blog on rajkotupdates.news : tax saving pf fd and insurance tax relief will help you taking right decision.