Suzlon Energy Limited is a leading renewable energy company in India. It has garnered significant interest from investors due to its focus on wind energy solutions. With the increasing global demand for renewable energy sources, the company’s shares have been under the spotlight. We will delve into suzlon share price performance and analysis, drawing insights from financial experts at Motilal Oswal.

Company Overview

Established in 1995, Suzlon Energy Limited is a prominent player in the renewable energy sector. This company primarily focuses on wind energy solutions. The company has a presence in more than 18 countries across Asia, Australia, Europe, Africa, and the Americas. With a diverse product portfolio, Suzlon has installed over 18.8 GW of wind energy capacity worldwide.

suzlon share price Performance

Suzlon’s share price has witnessed significant volatility in the past. It is primarily due to the company’s financial health and the overall market dynamics in the renewable energy sector. A detailed analysis by Motilal Oswal reveals various factors influencing the stock’s performance. It includes industry trends, government policies, and the company’s financial stability.

Industry Trends and Government Policies

The renewable energy sector has experienced substantial growth in recent years. It is driven by increasing awareness about climate change and the need for sustainable energy solutions. Governments worldwide have been implementing policies and incentives to promote the adoption of renewable energy technologies. It thus provides a favourable environment for companies like Suzlon.

Financial Stability

Suzlon has faced financial challenges in the past, including debt restructuring and liquidity issues. The company has taken several steps to improve its financial position, such as asset sales and cost optimization measures. These efforts have contributed to its share price performance and have been closely monitored by market analysts, including those at Motilal Oswal.

Expert Analysis by Motilal Oswal

Motilal Oswal, a renowned financial services firm, provides detailed research and analysis on suzlon share price performance. Their reports consider various factors. It includes the company’s financials, industry trends, government policies, and global market dynamics. Investors can benefit from Motilal Oswal’s insights to make informed decisions about their investments in Suzlon shares.

Yearly Share Price Data and Analysis

2017: suzlon share price witnessed fluctuations throughout 2017, with a peak at INR 22.75 in January and a low of INR 14.15 in December. The year saw a decline in investor sentiment due to concerns about the company’s debt and financial performance.

2018: The year 2018 proved to be a challenging period for Suzlon, with the share price dipping to INR 6.55 in December. Market headwinds, particularly in the renewable energy sector, and continued concerns about the company’s financial health contributed to this decline.

2019: suzlon share price remained under pressure in 2019, hitting a low of INR 2.25 in August. The company’s debt restructuring efforts, coupled with uncertainties in the renewable energy market, resulted in a lack of investor confidence.

2020: The COVID-19 pandemic and its impact on global economies further affected Suzlon’s share price in 2020. The stock reached a low of INR 1.95 in March but began to show signs of recovery towards the end of the year, touching INR 6.40 in December.

2021: suzlon share price saw an upward trend in 2021, reflecting renewed investor interest in the renewable energy sector. However, challenges such as high debt levels, global economic uncertainties, and increasing competition in the renewable energy market have resulted in fluctuations in the company’s share price.

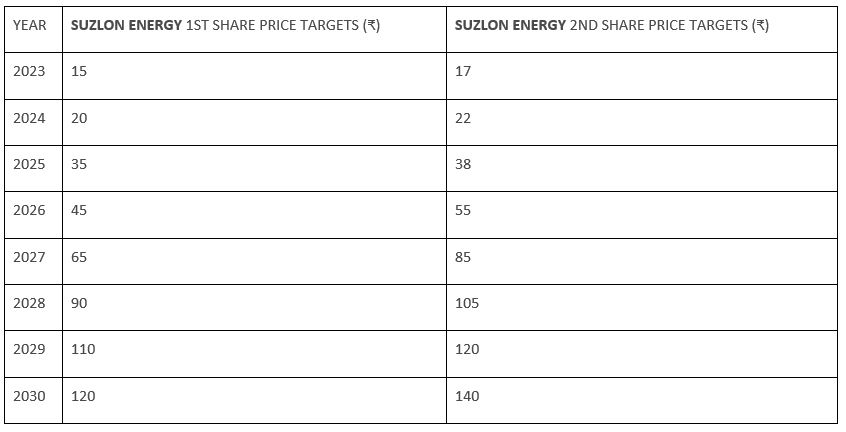

suzlon share price Target 2023

Over the past few years, Suzlon Energy has consistently demonstrated strong performance in its quarterly results, with notable increases in both sales and profits. The company has managed to significantly reduce its expenses, contributing to its growing profitability. As a result, analysts are optimistic about the potential growth of the company’s stock in the short term. As Suzlon Energy continues to deliver improved results through 2023, there is a strong possibility that the share price will reach an initial target of INR 15. Following this milestone, it is reasonable to expect a subsequent target of INR 17, offering further profit potential for investors.

suzlon share price Target 2024

Suzlon Energy is emerging as one of the largest wind energy companies in India, holding approximately 33% of the market share. In response to the growing demand for clean energy, the company is consistently focusing on expanding its power production capacity. Currently, Suzlon Energy has a capacity of 19,108 MW, and its management is planning to substantially increase investment each year to further boost capacity.

Additionally, Suzlon Energy is dedicated to enhancing its power production capacity through innovative improvements to its wind turbines. As the company’s power generation capacity expands in various ways, its market share is expected to grow accordingly.

Considering the anticipated growth in market share, the Suzlon Energy share price target could reach INR 20 by 2024, representing a significant increase. Following this initial target, it is plausible to expect a secondary target of INR 22, offering additional profit potential for investors.

suzlon share price Target 2026

Suzlon Energy’s management appears to be highly focused on reducing its debt as quickly as possible. To achieve this, the company is currently prioritizing projects with the highest profit margins, allowing them to rapidly increase profits and subsequently decrease their debt in the coming years.

Over the past few years, Suzlon Energy has managed to keep its debt burden under control to a significant extent. As a result, the company now faces lower interest rates each year, which has helped its business gradually become profitable. As debt continues to decrease, the company’s profits are expected to grow even more rapidly.

With the positive growth in business, the suzlon share price bse target for 2026 is anticipated to reach INR 35 as a first target. Following this, investors may potentially see a secondary target of INR 38, offering further profit opportunities.

suzlon share price Target 2030

Green Energy is expected to play a significant role in the future, as more and more people increase their reliance on environmentally friendly energy sources. The demand for Green Energy is anticipated to grow rapidly in response to this trend. Suzlon Energy’s management is continuously working to expand its production capacity, keeping in mind the growing opportunities in this sector.

Analysts predict that by 2030, Green Energy could account for up to 50% of India’s total energy consumption, benefiting not only Suzlon Energy but also other companies in the sector. As a leading company in this segment, Suzlon Energy is well-positioned to take advantage of this growing market. It will surely help to grow suzlon share price nse

Considering the potential for business growth, the suzlon energy share price target for 2030 could be around INR 120, offering substantial returns to shareholders. After reaching this target, investors may consider holding on for a secondary target of INR 140, presenting further profit opportunities.

Conclusion

As Suzlon Energy’s business (suzlon share price) presents considerable growth opportunities in the future, it also carries associated risks. When investing in this stock, it is advisable to allocate an amount of money that you can afford to lose. As the company continues to report positive results, you may gradually increase your investment. However, it is essential to consult with a financial advisor before making any investment decisions to ensure that you are making well-informed choices about suzlon share price

Also Read:Ticket to Wealth: IRCTC Share Price on a Winning Streak