What is Bearer Cheque?

A bearer cheque is a cheque that can be cashed by anyone who presents it for payment. A bearer cheque is not endorsed, meaning that the person or entity issuing the check does not need to sign the back of the document, nor does it need to be made out to any specific person. The person or entity endorsing the check could also be different from the payee.

A bearer cheque is essential because it provides a degree of anonymity to the person who has it. The person with the bearer cheque can use it to purchase goods or services without needing to present identification.

In some countries, bearer cheques are not allowed, and they are replaced with demand drafts and bankers’ drafts.

Bearer Cheque Limit

The bearer cheque limit is the amount of money that can be paid by a cheque. The bank sets this limit, and it varies from country to country. In many countries, the bearer cheque limit is around USD 10,000. Suppose someone tries to deposit a cheque for more than this amount.

Bearer checks in India have no withdrawal restrictions. However, if the sum is greater than Rs. 50,000, the bank requests identification and confirms the identity of the individual whose name the check was issued. The bank will then give the money to the bearer of the check or the individual presenting the check after the verification is complete.

Bearer Cheque Vs. Order Cheque

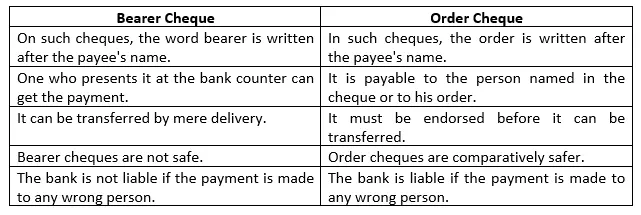

Bearer cheques are also known as order cheques. However, there are some differences present between bearer cheque and order cheque.

A bearer cheque is a cheque that is payable to the bearer or whoever has physical possession of it. These cheques are drawn on an account at a bank and cannot be cashed by anyone other than the bearer. At the same time, an order cheque is a cheque that can be signed or initiated by someone other than the payee to allow them to cash it. It can only be changed after it has been countersigned or signed by the payee. Here are some of the key differences between bearer cheque and order cheque.

Also Read: Exploring the Latest News and Updates on Air India